Finding the cheapest electric car insurance UK has become essential for drivers making the switch to electric vehicles. While EVs are cheaper to run in terms of fuel and maintenance, insurance costs can still be surprisingly high. Insurers often charge more because repairs and replacement parts for electric vehicles can be costly and specialised, which is why careful comparison is key to saving money.

Getting the best deal on electric car insurance involves understanding how policies work, comparing quotes from multiple providers, and considering the specific model you want to insure. Drivers can reduce costs by focusing on smaller vehicles in lower insurance groups, improving vehicle security, and exploring specialist EV insurance providers. With the right approach, it is possible to find the cheapest electric car insurance UK without compromising coverage.

Why Electric Car Insurance Can Be Expensive

Electric cars are generally more expensive to insure due to the advanced technology they contain. Components such as batteries, sensors, and electric drivetrains require specialist repair knowledge. If these parts need replacement, the costs can be significantly higher than for petrol or diesel cars. This naturally leads insurers to charge more, making it crucial for drivers to shop around for the cheapest electric car insurance UK.

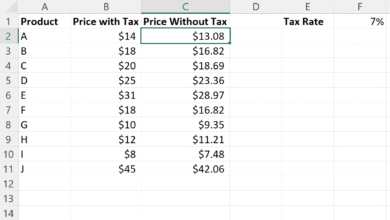

Insurance groups also play a major role in determining premiums. Vehicles in higher groups, such as premium or luxury electric cars, tend to have higher premiums because repair and replacement costs are more expensive. Factors like age, location, driving history, and previous claims history can further affect the price, so it’s important to consider all variables when searching for the cheapest electric car insurance UK.

Top Cheapest Electric Cars to Insure in the UK

Certain electric vehicles are consistently cheaper to insure. Models such as the Dacia Spring, Renault Twizy, and Mini Cooper Electric are well-known for their low premiums. The Fiat 500e and Hyundai Ioniq Electric are also popular choices for drivers looking to save on insurance costs, offering a balance of affordability, reliability, and low insurance group ratings.

Mainstream options like the Volkswagen ID.3 and VW e-Up! are suitable for those seeking more space or better features without a significant increase in insurance premiums. Choosing a car in a lower insurance group, with smaller dimensions and simpler repair requirements, is one of the most effective strategies for obtaining the cheapest electric car insurance UK while still enjoying modern EV benefits.

How to Find the Cheapest Electric Car Insurance UK

Comparison websites are one of the easiest ways to find the cheapest electric car insurance UK. Platforms like GoCompare, MoneySuperMarket, and Compare the Market allow drivers to compare multiple policies at once, filtering results to find the best price. These sites provide instant quotes, making it faster and simpler to identify suitable policies for your vehicle.

Specialist providers, including Vavista and AXA UK, often offer policies specifically designed for electric cars. Using these insurers can result in better rates and additional benefits such as roadside assistance, battery cover, or home charging protection. Combining specialist policies with traditional comparison sites maximises your chances of finding the cheapest electric car insurance UK available.

Cheapest Electric Car Insurance UK Reviews

Reading reviews is essential when selecting insurance for an electric vehicle. Customers often share detailed experiences about claims processing, customer service, and overall satisfaction, helping others make informed choices. Many comparison site reviews highlight which providers consistently offer affordable premiums, making it easier to select the cheapest electric car insurance UK.

Specialist EV insurers typically receive high ratings for their understanding of electric vehicle needs. Their policies often cover unique aspects of EV ownership, such as battery replacement, home charging equipment, and breakdown assistance. By reviewing customer feedback, drivers can find insurers that combine low premiums with reliable service, ensuring a safe and cost-effective insurance experience.

Additional Ways to Reduce Your EV Insurance Costs

Bundling insurance policies, such as combining home and car coverage, can often reduce premiums. Increasing voluntary excess or opting for limited mileage policies are additional strategies that help achieve the cheapest electric car insurance UK. These options allow drivers to tailor their insurance to their lifestyle while lowering costs.

Telematics or “black box” insurance is particularly beneficial for new drivers or those with limited driving experience. By monitoring driving behaviour, insurers can offer discounts for safe driving habits. Regularly reviewing your policy and comparing quotes ensures that you always have access to the best offers for the cheapest electric car insurance UK without sacrificing coverage.

Conclusion

Securing the cheapest electric car insurance UK requires careful research, comparison, and strategic planning. Choosing smaller EV models in lower insurance groups, using comparison websites, and considering specialist insurers can significantly reduce premiums. Maintaining a clean driving record, improving vehicle security, and exploring telematics policies can further enhance savings while keeping your coverage comprehensive.

By taking these steps, UK drivers can enjoy the benefits of electric vehicles without paying excessive insurance costs. The right approach ensures peace of mind, affordability, and the freedom to drive a modern EV with confidence.