Funded trading accounts UK have transformed the way traders access capital and develop professional skills. These accounts allow traders to trade with the resources of proprietary trading firms rather than risking their own money. UK traders now have access to various funded accounts, including free trials, instant funding, and programs designed specifically for beginners. The appeal is clear: trade large sums with limited risk while keeping a portion of profits.

The rise of funded trading accounts UK reflects the growing interest in prop trading among UK traders. With proper evaluation and compliance with rules, these accounts offer a realistic pathway to professional trading. From forex to futures, traders can test strategies, scale their accounts, and gain confidence. Whether you are a novice or an experienced trader, funded trading accounts UK provide opportunities to grow capital efficiently.

What Are Funded Trading Accounts UK

Funded trading accounts UK are accounts provided by prop firms that allow traders to operate with the firm’s capital. Unlike traditional trading accounts, they minimise personal financial risk while providing access to larger sums of money. Traders typically undergo an evaluation or challenge to demonstrate trading skill and discipline before receiving funding.

These accounts also include structured trading rules, risk management guidelines, and profit-sharing arrangements. Funded trading accounts UK are ideal for those who want to trade professionally without substantial personal investment. They offer a balance between opportunity and risk management, making them increasingly popular among UK traders seeking to advance their careers in financial markets.

How Funded Trading Accounts UK Work

Funded trading accounts UK operate through a process that usually begins with registration with a prop firm. Traders may be required to complete an evaluation or challenge that tests their trading abilities and risk management skills. Upon passing, the trader receives a funded account and can trade in real market conditions with the firm’s capital.

Profit-sharing is a key feature of funded trading accounts UK. Traders earn a percentage of profits, which varies by firm and account type, while the firm retains the remainder. Some UK firms also provide instant funding accounts, allowing traders to skip lengthy evaluations. Understanding the rules and requirements is essential to succeed and maximise earnings while using these accounts.

Advantages of Funded Trading Accounts UK

One of the main benefits of funded trading accounts UK is access to large capital without personal risk. Traders can experiment with strategies, gain experience in live markets, and scale their accounts progressively. Many accounts also provide mentorship, educational resources, and trading tools that help traders improve performance.

Additionally, funded trading accounts UK allow traders to build a professional track record. Success in a funded account can lead to higher funding, more capital, and better profit-sharing terms. For UK traders, this presents a significant opportunity to grow their trading career while learning risk management and market discipline in a controlled environment.

Top Funded Trading Accounts UK in 2026

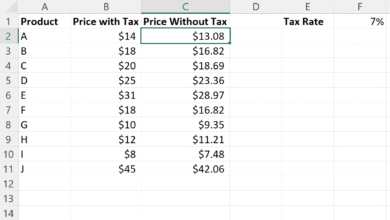

The UK market offers a variety of top funded trading accounts UK, catering to different trading styles and experience levels. Some accounts are free with no deposit required, making them ideal for beginners. Others provide instant funding for experienced traders seeking immediate access to capital. Comparison tables can help traders evaluate features such as leverage, payout structure, and evaluation difficulty.

Reviews from traders provide additional insight into funded trading accounts UK. Positive feedback often highlights transparent rules, fast withdrawals, and supportive customer service. For beginners, selecting an account with educational resources and simple evaluation processes ensures a smoother start. By choosing carefully, traders can maximise their chances of long-term success and profitability.

Choosing the Best Funded Trading Accounts UK

Selecting the best funded trading accounts UK requires careful consideration. Factors to evaluate include account size, profit split, trading rules, and withdrawal policies. Reading reviews, exploring forums, and checking reputation help traders identify trustworthy firms. Beginners should focus on accounts designed for learning and gradual growth.

Funded trading accounts UK for beginners often provide additional guidance, such as risk management tools and mentoring. Traders should also consider whether they prefer instant funding or standard evaluation challenges. Making informed choices ensures that the selected funded trading account aligns with personal skills, trading style, and long-term goals.

Tips for Succeeding with Funded Trading Accounts UK

Success with funded trading accounts UK relies on consistent strategy, discipline, and adherence to rules. Traders must manage risk, monitor performance, and follow daily and weekly trading limits. Failure to comply with guidelines can result in account suspension or loss of funding, so understanding the rules is crucial.

Additionally, traders should focus on continuous learning, adapting strategies based on performance, and using analytics tools. By tracking progress and refining approaches, funded trading accounts UK become a pathway to professional growth. Combining education, practice, and careful account selection ensures both profitability and career development in trading.

Conclusion

Funded trading accounts UK offer an unparalleled opportunity for traders to access significant capital while limiting personal risk. From free beginner accounts to instant funding for experienced traders, the UK market has a variety of options. By carefully choosing accounts, understanding rules, and following best practices, traders can grow their trading careers effectively and profitably.

For 2026 and beyond, funded trading accounts UK remain an attractive option for traders seeking professional development. With proper strategy, risk management, and selection of top accounts, UK traders can scale their funds, gain market experience, and enjoy a sustainable path to trading success.