Flatfair no deposit is changing the way tenants rent in the UK by providing a modern alternative to traditional cash deposits. Instead of paying a large sum upfront, tenants can secure a property by paying a smaller, one-off check-in fee. This system helps renters manage their finances better, especially in high-cost areas, while landlords still receive protection against damages or unpaid rent.

The rise of flatfair no deposit reflects a shift towards convenience and fairness in renting. By using this innovative scheme, tenants can avoid the stress of saving for a full deposit and instead use their money for other moving expenses or necessities. The platform ensures transparency and provides a reliable method to manage end-of-tenancy responsibilities efficiently.

What is Flatfair No Deposit

Flatfair no deposit is a deposit replacement scheme that allows tenants to move into a property without paying a traditional five-week cash deposit. Instead, tenants pay a one-off check-in fee, typically 28% of one month’s rent plus VAT, or a minimum set amount. This option offers greater financial flexibility for tenants while maintaining accountability for property care and rent payments.

This scheme is designed to benefit both tenants and landlords. While tenants enjoy reduced upfront costs, landlords receive guaranteed protection through the platform. The flatfair no deposit option ensures that any damages or unpaid rent are handled fairly and efficiently, offering a transparent and legally secure approach to renting that appeals to modern renters across the UK.

How Flatfair No Deposit Works

The flatfair no deposit process is simple and efficient. Tenants first pay a one-off check-in fee to secure the property, which replaces the traditional deposit. This fee allows tenants to move in quickly, without the financial strain of a large upfront payment. Once the tenancy begins, tenants are responsible for any damages or unpaid rent, but these are managed through the platform.

At the end of the tenancy, flatfair no deposit provides a clear and streamlined dispute resolution process. Independent adjudication ensures fairness for both parties, avoiding the delays often associated with traditional deposit returns. This system makes renting faster, fairer, and more manageable, while still giving landlords the protection they need to feel confident in letting their property.

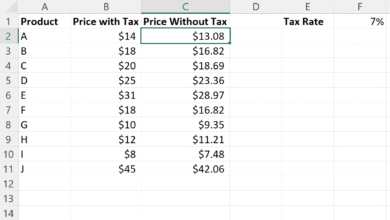

Costs and Fees Explained

Flatfair no deposit is designed to be transparent and cost-effective. Tenants pay a single check-in fee instead of a traditional deposit, which is often less than five weeks’ rent. This can save hundreds or even thousands of pounds upfront, making it easier to move in and cover other expenses. The fee structure is straightforward, with no hidden costs, renewal fees, or ongoing charges.

This deposit alternative is especially beneficial for students, young professionals, and first-time renters who may struggle to afford a full deposit. By choosing flatfair no deposit, tenants can plan their finances more effectively and enjoy a smoother move-in process. The affordability and simplicity of this system have made it a popular option in cities across the UK.

Benefits of Using Flatfair No Deposit

One of the main advantages of flatfair no deposit is the reduction of upfront costs. Tenants no longer need to save large sums for deposits, allowing them to allocate funds toward moving, bills, or other essentials. This flexibility can make renting more accessible and less stressful, particularly for those moving into expensive urban areas.

Additionally, flatfair no deposit provides a transparent method for managing end-of-tenancy charges. The platform simplifies disputes and ensures fair resolutions, protecting both tenants and landlords. With faster check-ins and check-outs, this scheme improves the rental experience overall. Landlords benefit from enhanced security, while tenants enjoy a hassle-free, modern alternative to traditional deposits.

Considerations and Potential Drawbacks

While flatfair no deposit reduces upfront financial pressure, tenants remain liable for any damages or unpaid rent. Disputes are resolved via the platform rather than through traditional deposit schemes, which may be unfamiliar to some tenants. Understanding responsibilities and documenting the property condition on move-in can help avoid unexpected charges later.

Some landlords may be cautious about using flatfair no deposit if they are unfamiliar with the scheme. It is important for tenants to communicate openly and follow platform guidelines to ensure a smooth experience. By being informed, renters can fully benefit from the convenience and financial flexibility offered by this modern deposit alternative.

Flatfair No Deposit Reviews

Reviews of flatfair no deposit often highlight its affordability and convenience. Tenants appreciate being able to move in without the burden of a large deposit, and landlords note the protection provided against damages or unpaid rent. While some users mention that disputes can take time, the majority praise the clarity and fairness of the system.

Overall, flatfair no deposit reviews show it is a trusted and widely used alternative to traditional deposits. The scheme is popular among students, professionals, and families seeking flexibility in renting. Many users recommend it as a modern, efficient, and fair way to secure a rental property in the UK.

How to Apply for Flatfair No Deposit

Applying for flatfair no deposit is simple and straightforward. Tenants provide identification and tenancy details, pay the check-in fee, and secure the property. The platform guides both tenants and landlords through each step, ensuring compliance with legal requirements and a smooth rental process.

To maximise the benefits of flatfair no deposit, tenants should check eligibility, provide accurate documentation, and understand their responsibilities. Following these steps ensures a stress-free move-in and avoids potential disputes at the end of the tenancy. This innovative scheme makes renting more accessible, affordable, and convenient for tenants across the UK.

Conclusion

Flatfair no deposit is revolutionising rental agreements in the UK. By replacing traditional deposits with a smaller, upfront fee, tenants enjoy reduced costs, faster move-ins, and a transparent method for managing disputes. Landlords benefit from continued protection and simplified management, creating a balanced system that works for everyone involved.

For tenants looking to move without financial strain, flatfair no deposit offers a practical and fair solution. Understanding the process, costs, and responsibilities ensures a positive rental experience. With growing adoption, this scheme represents the future of modern renting in the UK, providing both flexibility and security.