Understanding your gross income based on net pay can be challenging, especially in the UK where tax bands, National Insurance, and other deductions affect take-home pay. A reverse tax calculator UK is designed to simplify this process. It allows you to determine the pre-tax salary you need to achieve a specific net income, making financial planning and budgeting far easier for individuals and businesses alike.

The reverse tax calculator UK is particularly useful for employees negotiating salaries, freelancers invoicing clients, or anyone wanting a clear understanding of their earnings. By working backwards from net income, it removes the guesswork from complicated calculations. Whether you are planning finances, comparing job offers, or managing business income, this tool is indispensable for UK residents.

What is a Reverse Tax Calculator UK?

A reverse tax calculator UK is a digital tool that calculates gross salary from net income. Unlike standard tax calculators, which show take-home pay from gross salary, reverse tax calculators work in reverse. This allows users to understand exactly how much they need to earn before deductions. It is an essential tool for employees, self-employed individuals, and small business owners in the UK.

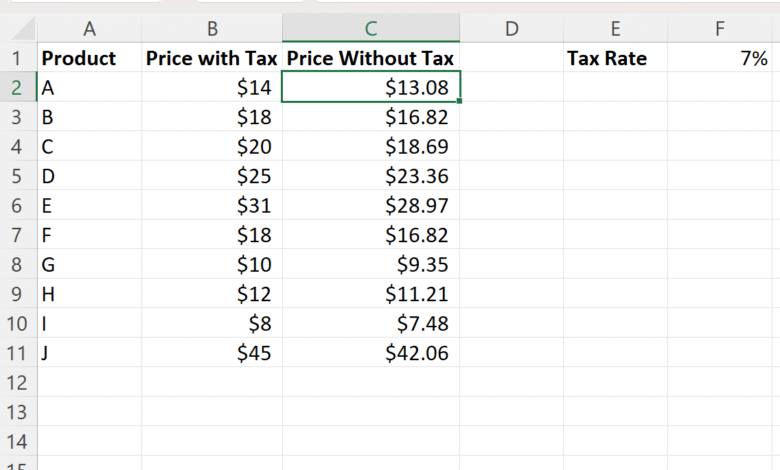

In addition to calculating salary, a reverse tax calculator UK can assist with other financial calculations, including freelance invoices and VAT adjustments. By entering net income or net price, the calculator quickly generates the gross amount. This saves time, reduces errors, and ensures financial accuracy, which is vital for effective budgeting and planning.

How Reverse Tax Calculations Work in the UK

Reverse tax calculations in the UK require a detailed understanding of income tax, National Insurance contributions, and other deductions. A reverse tax calculator UK uses these factors to accurately determine gross income from net pay. Without such a tool, manually calculating gross income can be time-consuming and prone to errors, especially with changing tax bands or allowances.

To calculate reverse tax manually, you would need to account for tax rates, personal allowances, and potential student loan deductions. A reverse tax calculator UK automates this process, saving effort and ensuring precise results. It is particularly valuable for self-employed individuals who need to understand their pre-tax income for invoicing and budgeting purposes.

Benefits of Using a Reverse Tax Calculator UK

Using a reverse tax calculator UK offers multiple benefits. It allows employees to plan their finances with confidence, ensuring they know the gross salary required to reach their desired take-home pay. The calculator is quick, accurate, and eliminates the need for complex manual calculations. This helps individuals avoid underestimating or overestimating their earnings.

For self-employed professionals and freelancers, a reverse tax calculator UK ensures that invoices reflect the correct pre-tax amount. It also helps businesses maintain compliance with HMRC by accurately including tax and deductions. Overall, this tool enhances financial transparency, reduces stress, and supports better decision-making for UK residents and businesses.

Top Reverse Tax Calculator Tools in the UK

Several online platforms offer reliable reverse tax calculator UK tools. HMRC provides official calculators, while other trusted websites offer user-friendly interfaces for salary and VAT calculations. These tools consider UK tax rates, National Insurance, and personal allowances, providing precise results in seconds. Each tool varies in features, so users should choose based on their specific needs.

The best reverse tax calculator UK tools often include options for freelancers, employees, and small businesses. Some calculators also allow VAT adjustments, making them versatile for multiple financial scenarios. By using these tools, UK residents can plan their budgets, negotiate salaries, and manage business finances with accuracy and confidence.

Reverse VAT Calculator in the UK

A reverse VAT calculator UK is essential for businesses needing to calculate net prices from gross amounts including VAT. It helps remove VAT from a price, making it easier to determine the actual amount before tax. This is especially useful for businesses that need to adjust invoices or manage VAT submissions to HMRC accurately.

Using a reverse VAT calculator UK ensures compliance and financial accuracy. It eliminates confusion when dealing with multiple VAT rates and allows businesses to calculate net values quickly. Combining a reverse tax calculator UK with a VAT calculator provides a comprehensive view of finances, supporting smarter budgeting and efficient financial planning in the UK.

Common Mistakes to Avoid When Using a Reverse Tax Calculator UK

One common mistake is ignoring personal allowances or National Insurance contributions, which can lead to inaccurate results. Another frequent error is using outdated calculators that do not reflect the current tax year. A reliable reverse tax calculator UK automatically incorporates up-to-date tax bands, ensuring precise calculations for gross income.

Users should also avoid confusing gross and net amounts when inputting data. Double-checking figures against official HMRC sources improves accuracy and prevents miscalculations. By using a reverse tax calculator UK correctly, individuals and businesses can confidently plan finances, avoiding errors that could lead to underpayment or mismanagement of income.

Conclusion

A reverse tax calculator UK is an invaluable tool for anyone in the UK wanting to calculate gross income from net pay accurately. It simplifies complex tax calculations, saves time, and ensures financial planning is precise. Whether for salary negotiation, freelance invoicing, or VAT adjustments, the calculator is essential for modern financial management.

By integrating a reverse tax calculator UK into your budgeting process, you gain clarity, accuracy, and confidence in managing your finances. It ensures that pre-tax earnings are correctly calculated, allowing individuals and businesses to make informed financial decisions and maintain compliance with UK tax regulations.