Importing goods from Japan to the UK can be both exciting and complex. Many individuals and businesses underestimate the amount of tax and customs duty they will need to pay. Using a Japan to UK import tax calculator helps avoid surprises at customs, giving you an accurate estimate of the duty, VAT, and other associated fees. Planning ahead ensures smoother transactions and fewer delays.

With international trade becoming more common, understanding import costs is essential. A Japan to UK import tax calculator provides transparency and helps importers make informed decisions. It allows users to input product details, shipping costs, and insurance, giving a clear picture of the total import charges. This tool is particularly valuable for small businesses and first-time importers.

What is the Japan to UK Import Tax Calculator?

The Japan to UK import tax calculator is an online tool designed to simplify the process of calculating import duties and VAT. It uses the value of your goods, product category, and shipping costs to provide an accurate estimate of the taxes you may owe. Using this calculator ensures you know your financial obligations before the shipment arrives.

This tool is particularly helpful for avoiding mistakes that could lead to delays or unexpected costs. Many importers fail to account for VAT or customs duty, which can be significant. By using the Japan to UK import tax calculator, you can quickly determine the total amount payable, plan your budget effectively, and avoid unnecessary stress during the import process.

How Import Tax and Duty Are Calculated in the UK

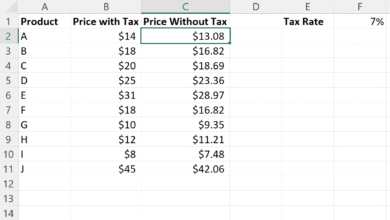

Import taxes in the UK include customs duty and VAT, both of which are calculated differently. Customs duty is based on the product’s classification under the Harmonised System (HS) code, while VAT is calculated on the combined cost of the goods, duty, shipping, and insurance. The Japan to UK import tax calculator simplifies these complex calculations for importers.

The calculator allows users to enter product information and receive an accurate estimate of their total import costs. It accounts for shipping and insurance, ensuring the VAT calculation is precise. This makes it an indispensable tool for individuals and businesses who import goods from Japan, giving them confidence in their budgeting and planning.

Step-by-Step Guide to Using the Japan to UK Import Tax Calculator

Using the Japan to UK import tax calculator is straightforward. Start by entering the product details, including description, category, and value. Accurate information is essential, as even minor errors can affect the calculation of duty and VAT. Once entered, the calculator applies the correct UK duty rates to your items.

Next, include shipping and insurance costs, which are added to the total value for VAT purposes. The calculator then provides a breakdown of customs duty, VAT, and total import costs. By using this tool, importers can compare shipping methods, identify cost-saving opportunities, and plan their imports efficiently, avoiding unexpected charges at customs.

Common Mistakes to Avoid When Importing from Japan

One common mistake is forgetting to include shipping and insurance in tax calculations. Many importers only consider the value of the goods, leading to underpayment of VAT and customs duty. The Japan to UK import tax calculator ensures all relevant costs are factored in for accurate estimates.

Another mistake is using outdated duty rates or misclassifying products. Proper classification using HS codes is critical for precise duty calculations. The Japan to UK import tax calculator automatically applies current rates, reducing the risk of errors and helping importers comply with UK customs regulations efficiently.

Tips for Reducing Import Costs

There are several strategies to reduce import costs when bringing goods from Japan to the UK. Choosing the right shipping method, consolidating multiple items into a single shipment, and understanding trade agreements or exemptions can significantly lower duty and VAT. The Japan to UK import tax calculator allows you to test different scenarios and identify the most cost-effective approach.

Importers should also consider the timing of their shipments. Certain periods may have higher shipping rates or customs delays, increasing overall costs. Using a Japan to UK import tax calculator alongside strategic planning ensures you minimise unnecessary expenses and make the most of every shipment, helping both individuals and businesses save money.

Frequently Asked Questions About Japan to UK Import Tax

Many people wonder what the customs duty rates are for goods imported from Japan to the UK. Using a Japan to UK import tax calculator provides accurate estimates based on product type and value. It ensures that importers are prepared for all charges.

Another common question is whether businesses can reclaim VAT. The Japan to UK import tax calculator helps estimate VAT payable and gives insights into reclaim processes for eligible businesses. Shipping costs, insurance, and proper product classification all impact calculations, and the tool ensures accuracy and transparency for anyone importing from Japan.

Conclusion

A Japan to UK import tax calculator is essential for anyone importing goods from Japan. It removes uncertainty, allowing importers to calculate customs duty, VAT, and total import costs accurately. Using this tool saves time, avoids unnecessary charges, and ensures smooth import transactions. By planning ahead and using the calculator, importers can make smarter financial decisions and import with confidence.