Air rifle ownership in the UK is popular for recreational shooting, target practice, and pest control activities. Despite the widespread use of air rifles, many shooters underestimate the potential risks associated with handling these firearms. Accidental injury, damage to property, or third-party claims can occur even in controlled environments, making air rifle insurance a crucial consideration for responsible owners.

Air rifle insurance provides financial and legal protection in case of unexpected events. While it is not a legal requirement in most areas of the UK, having appropriate cover ensures that shooters can manage potential claims, protect their property, and avoid disputes. Understanding the importance of air rifle insurance is the first step towards safer and more responsible shooting.

what air rifle insurance covers in practice

Air rifle insurance usually includes public liability protection, which covers compensation claims and legal fees if someone is injured or property is damaged during shooting. Even minor incidents can result in substantial costs, making liability cover essential for every air rifle owner. This protection is particularly important for those shooting on private land or at clubs that require proof of insurance.

In addition to liability, many policies offer optional benefits such as legal expenses cover and protection for personal injury. Some insurers also provide cover for theft, loss, or accidental damage to the air rifle itself. Choosing a policy that matches your needs ensures comprehensive protection while giving peace of mind when shooting in various environments.

do you need air rifle insurance in the uk

While air rifle insurance is not legally mandated in the UK, it is strongly recommended for responsible shooters. Landowners, shooting clubs, and pest control clients often require proof of cover before granting permission to use an air rifle on their property. Without insurance, shooters may face denied access or legal disputes if an accident occurs during use.

For pest control or professional shooting activities, air rifle insurance becomes even more critical. Shooting around livestock, farmland, or buildings increases the potential for third-party claims. A robust insurance policy demonstrates professionalism, protects the shooter from financial loss, and ensures that pest control operations can continue without interruption or legal complications.

types of air rifle insurance available

The core of most air rifle insurance policies is public liability cover, designed to protect shooters from claims arising from injury or property damage. Coverage limits vary depending on the provider, and it is vital to choose a policy that provides sufficient protection for both recreational and professional use.

Additional cover options often include personal accident protection, legal expenses, and equipment insurance. Personal accident cover compensates for injuries sustained while shooting, while equipment cover protects the rifle and related gear from theft, loss, or accidental damage. Selecting the right combination of cover ensures that all potential risks associated with air rifle use are adequately addressed.

air rifle insurance for pest control

Air rifle insurance for pest control is essential for shooters who use their rifles to manage vermin or wildlife on farms and private properties. Professional pest control activities carry a higher risk of damage to property or accidental injury, making comprehensive insurance cover a requirement rather than an optional safeguard.

Policies tailored for pest control typically include enhanced liability limits, protection for multiple shooting locations, and optional equipment cover. Having the right insurance reassures landowners and clients that any incidents will be managed professionally, and it safeguards the shooter against potential legal and financial consequences.

best air rifle insurance uk providers

In the UK, shooters have several options for air rifle insurance. Organisations such as BASC, CCC, NGO, and BASA offer policies tailored to the needs of recreational and professional shooters. These providers often include membership benefits, legal support, and resources for safe shooting practices alongside insurance cover.

Choosing the best air rifle insurance UK provider involves comparing coverage limits, policy inclusions, and suitability for your shooting activities. Some providers specialise in pest control insurance, while others focus on recreational or club-based shooting. Evaluating these factors ensures that shooters receive the right level of protection without paying for unnecessary extras.

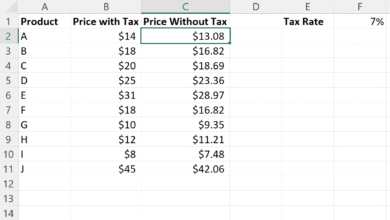

cheapest air rifle insurance and costs in the uk

The cost of air rifle insurance in the UK is generally reasonable, with annual policies starting from as little as £17–£20 for basic public liability cover. While cheaper policies may be attractive, they often offer lower coverage limits and may exclude essential benefits such as equipment protection or personal accident cover.

Factors affecting the price of air rifle insurance include the type of shooting, frequency of use, professional activity, and policy limits. Comprehensive policies with higher limits or additional cover options cost more but provide greater peace of mind and protection. Comparing policies carefully allows shooters to balance affordability with adequate coverage.

choosing the right air rifle insurance

Selecting the right air rifle insurance requires understanding your specific shooting activities and risks. Recreational shooters may only need public liability cover, while pest control professionals should consider additional equipment and personal accident protection. Assessing the level of cover and potential exclusions is vital to avoid unexpected problems later.

Reviewing multiple providers, checking policy limits, and ensuring compliance with UK regulations are essential steps when choosing air rifle insurance. The best policy is one that matches your shooting habits, protects against potential risks, and provides confidence in all shooting scenarios, whether at home, in clubs, or on clients’ properties.

conclusion

Air rifle insurance is a key consideration for UK shooters, providing protection against accidents, injuries, and third-party claims. While not legally required in most areas, it is strongly recommended for recreational, club-based, and professional shooting activities. Choosing the right policy ensures both legal and financial protection while demonstrating responsible and safe shooting practices.

By understanding what air rifle insurance covers, the costs involved, and the best UK providers, shooters can make informed decisions that protect themselves and others. Comprehensive insurance safeguards not only the shooter but also property, clients, and fellow enthusiasts, ensuring shooting remains a safe and enjoyable activity.