Selling on Amazon has become an attractive opportunity for UK entrepreneurs, but the financial side of the business is often underestimated. From complex settlement reports to fluctuating fees and refunds, Amazon’s system can quickly overwhelm sellers who attempt to manage everything alone. This is why accountants for amazon sellers are increasingly seen as an essential part of building a sustainable and compliant eCommerce business rather than an optional extra.

Specialist accounting support allows Amazon sellers to focus on sourcing products, improving listings, and growing sales while professionals manage the numbers. With UK tax rules, VAT obligations, and Amazon-specific reporting all intersecting, having expert guidance ensures accuracy and clarity. Over time, this support becomes a strategic advantage rather than just an administrative necessity.

Understanding the role of accountants for amazon sellers

Accountants for amazon sellers specialise in handling the financial structure unique to Amazon businesses. Unlike traditional accountants, they understand how Seller Central works, how settlements are generated, and how fees such as FBA storage, fulfilment, and advertising costs affect profitability. This knowledge allows them to translate raw Amazon data into meaningful financial reports that sellers can rely on.

Beyond data entry, these specialists act as advisors. They help sellers understand their true margins, identify unnecessary costs, and plan for tax liabilities well in advance. By aligning accounting practices with the realities of selling on Amazon, they ensure that financial decisions are based on accurate, up-to-date information rather than assumptions or incomplete figures.

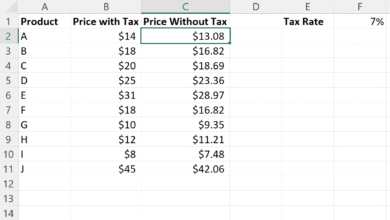

Bookkeeping, reconciliation, and financial clarity

Accurate bookkeeping is one of the most valuable services provided by accountants for amazon sellers. Amazon payouts rarely match gross sales due to fees, refunds, chargebacks, and reimbursements. Specialist accountants reconcile settlement reports line by line, ensuring that every transaction is recorded correctly and that financial statements truly reflect business performance.

This level of detail provides clarity that generic bookkeeping often misses. Sellers gain a clear view of cash flow, profitability, and trends over time. With consistent reconciliation, it becomes easier to spot issues early, forecast future performance, and make informed decisions about pricing, stock levels, and marketing spend.

VAT, tax compliance, and UK regulations

Tax compliance is one of the most challenging aspects of running an Amazon business in the UK. VAT rules can be particularly complex, especially for sellers using FBA or selling across borders. Accountants for amazon sellers understand these requirements and ensure that registrations, filings, and payments are handled correctly and on time.

In addition to VAT, specialist accountants manage Corporation Tax or Self-Assessment obligations and ensure compliance with Making Tax Digital. They also advise on tax efficiency, helping sellers structure their businesses in a way that supports growth while remaining fully compliant with HMRC requirements. This proactive approach reduces risk and prevents costly mistakes.

Supporting growth and long-term profitability

As an Amazon business grows, financial management becomes increasingly important. Accountants for amazon sellers provide insights that go beyond compliance, helping sellers understand which products are truly profitable and which may be draining resources. By analysing costs, margins, and cash flow, they support smarter decision-making and sustainable scaling.

Strategic advice is particularly valuable during periods of growth. Whether expanding product ranges, entering new marketplaces, or increasing advertising spend, sellers benefit from clear financial projections. With expert guidance, growth becomes controlled and intentional rather than reactive, reducing the likelihood of cash flow problems or unexpected tax burdens.

Choosing the right accounting partner for your Amazon business

Selecting the right accountants for amazon sellers requires careful consideration. Experience with Amazon and eCommerce should be a priority, along with a clear understanding of UK tax regulations. Reviews and testimonials can offer insight into how effectively an accountant supports similar businesses and whether their communication style suits your needs.

Many UK sellers now work with remote specialists rather than local firms, benefiting from nationwide expertise and digital tools. What matters most is transparency, reliability, and a proactive approach to advice. The right accounting partner becomes an extension of your business, supporting compliance, profitability, and long-term success.

Conclusion and common considerations for Amazon sellers

Working with accountants for amazon sellers transforms the way UK businesses manage their finances. Instead of reacting to problems, sellers gain clarity, confidence, and control. From accurate bookkeeping to strategic tax planning, specialist support enables Amazon businesses to operate professionally and grow sustainably in a competitive marketplace.

Sellers often question whether specialist accounting is worth the investment, especially in the early stages. While simple tools may suffice initially, professional expertise quickly becomes essential as sales increase. Choosing the right support early can prevent costly errors, improve profitability, and lay strong foundations for long-term success on Amazon.